Defaulting on an MCA: Understanding, Consequences, & Prevention

A Merchant Cash Advance (MCA) is a type of financing option used primarily by small and medium-sized businesses to gain quick access to capital. Unlike traditional loans, an MCA provides a lump-sum payment in exchange for a percentage of future credit card sales or daily bank deposits. While this form of funding is fast and relatively easy to obtain, it comes with high costs and rigid repayment structures.

Defaulting on an MCA occurs when a business fails to meet the agreed-upon terms of the repayment. This can lead to severe financial, legal, and operational consequences for the borrower. In this article, we’ll explore what it means to default on an MCA, the signs, the aftermath, and how to prevent or handle such a situation strategically.

What is an MCA and How Does It Work?

An MCA is not technically a loan. It is an advance based on a company’s expected sales. The funder provides a lump sum—say $50,000—and the business agrees to pay back that amount plus a fixed fee (known as a factor rate), often between 1.1 to 1.5. This means the total repayment could be $55,000 to $75,000 or more, depending on terms.

Repayment is usually structured in one of two ways:

- Percentage of Daily Credit Card Sales: Often between 10–20%.

- Fixed Daily or Weekly ACH Withdrawals: Automatically debited from the business’s bank account.

Unlike traditional loans with longer terms and interest rates, MCAs are short-term (usually 3–18 months) and the repayments begin almost immediately after funding.

What Does It Mean to Defaulting on an MCA?

Defaulting on an MCA means that the business has failed to make the agreed-upon payments as scheduled. This could happen due to a cash flow crunch, a drastic drop in sales, or unforeseen circumstances like supply chain issues, market changes, or economic downturns.

MCA lenders have very aggressive repayment models, and missing even a few payments can trigger a default. Most MCA contracts have clauses that give lenders significant power in the event of non-payment, including:

- Confession of judgment (COJ)

- UCC-1 liens

- Freezing business bank accounts

- Filing lawsuits without notice

Unlike banks, MCA providers often bypass traditional legal processes due to these provisions, which makes defaulting on an MCA more dangerous and immediate.

What Can Happen if You Default on an MCA?

Defaulting on a Merchant Cash Advance (MCA) can lead to serious financial and legal consequences for your business—and even for you personally, depending on the terms of your agreement. Unlike traditional loans, MCAs are often tied to aggressive collections and legal tactics due to their high-risk nature. Once you default, the provider may immediately move to recover the full remaining balance, not just the missed payments. Many MCA contracts include confession of judgment (COJ) clauses, allowing the lender to obtain a court judgment without notice or a trial, giving them legal access to your bank accounts or business assets.

In addition to legal action, your business could face asset seizures, account freezes, and collection lawsuits. Providers may also file Uniform Commercial Code (UCC) liens against your business, limiting your ability to obtain other financing. Personal guarantees included in the agreement may put your personal assets and credit at risk as well. Furthermore, defaulting can damage your business’s credit profile, making it much harder to secure future funding or vendor relationships.

In extreme cases, MCA providers may employ aggressive third-party collectors, which can further strain your operations. This is why it’s critical to act fast at the first sign of financial trouble—by communicating with your provider or seeking legal and financial help—to explore alternatives before default occurs.

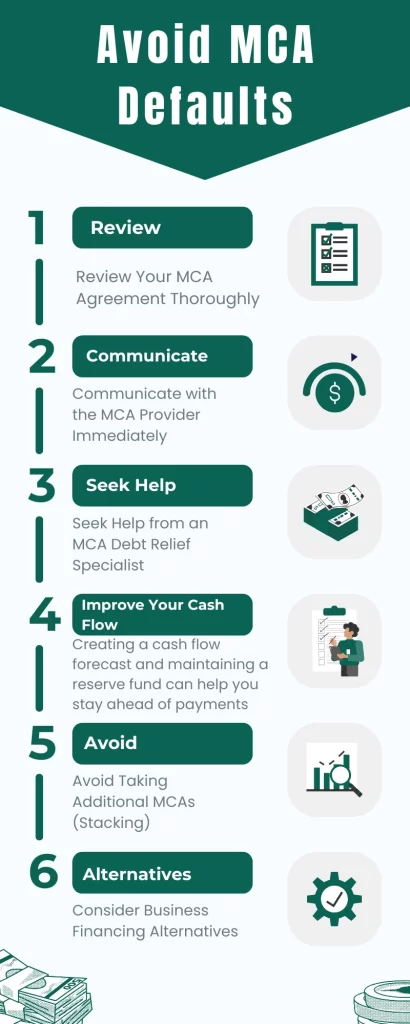

How to Avoid MCA Defaults?

If you’re already struggling with your Merchant Cash Advance (MCA) and at risk of defaulting—or have already defaulted—there are actionable steps you can take to stop the situation from escalating. The key is to act quickly, strategically, and with transparency, because the longer you delay, the more aggressive the consequences can become.

1. Review Your MCA Agreement Thoroughly

Start by carefully reviewing the terms and clauses in your MCA contract. Identify what specifically triggers a default, whether there’s a confession of judgment (COJ), personal guarantee, or daily deduction requirement. Understanding the contract helps you know your rights and the lender’s legal limits. Knowing exactly where you stand will guide your next moves more effectively.

2. Communicate with the MCA Provider Immediately

Reach out to your MCA provider as soon as you know you can’t meet your payment obligations. Many lenders are open to negotiation, especially if they believe you’re acting in good faith. You may be able to restructure the repayment plan, request a temporary reduction in deductions, or agree on a deferred payment schedule. Lenders may prefer restructuring over legal proceedings, which can be costly and time-consuming for both parties.

3. Seek Help from an MCA Debt Relief Specialist

If communication fails or you’re overwhelmed by multiple advances, contact a professional MCA debt relief firm or a qualified attorney. These professionals can negotiate with lenders on your behalf, consolidate multiple MCAs, or even help defend you legally if a COJ or lawsuit has been filed. They can also help you settle the debt for less than what you owe or structure a managed payment plan to stop defaulting.

4. Improve Your Cash Flow Management

Take control of your business’s finances to ensure you can consistently make payments. This may include:

- Cutting non-essential expenses

- Boosting revenue through short-term promotions

- Delaying non-urgent purchases or expansions

- Renegotiating terms with vendors to free up cash

Creating a cash flow forecast and maintaining a reserve fund can help you stay ahead of payments and avoid another default.

5. Avoid Taking Additional MCAs (Stacking)

Many businesses make the mistake of taking out additional MCAs to cover existing ones, a practice known as stacking. This only deepens your financial hole and increases your risk of future default. If you’ve already stacked advances, it’s even more crucial to seek professional assistance to break the cycle and consolidate the debt responsibly.

6. Consider Business Financing Alternatives

Explore lower-risk funding alternatives such as SBA loans, business lines of credit, invoice factoring, or term loans with better interest rates and more flexible repayment terms. These options may be harder to qualify for but offer far more sustainable solutions compared to the high-pressure structure of an MCA.

Taking steps to stop defaulting on an MCA is not just about catching up on payments—it’s about restructuring your business’s financial foundation to ensure long-term stability. Acting early, seeking expert guidance, and making responsible financial decisions are key to breaking free from the MCA trap.

When Are You Considered in Default of Your MCA?

You are typically considered in default of your Merchant Cash Advance (MCA) agreement when you fail to meet the repayment terms outlined in your contract. Unlike traditional loans, MCAs often require daily or weekly payments based on your business’s revenue. Missing even a few of these scheduled payments can trigger a default, especially if the provider is strict or if the agreement includes automatic default clauses.

Common signs of default include returned debits, insufficient funds in your business account, or a significant drop in sales that prevents consistent payments. Additionally, most MCA contracts contain clauses such as confession of judgment (COJ) or breach of representation, meaning even actions like closing your business bank account, taking on additional debt without disclosure, or providing inaccurate financial information can be grounds for default.

It’s crucial to thoroughly review your MCA agreement to understand what specific conditions could lead to default, as the consequences can be swift and severe.

How to Avoid a MCA Default?

Avoiding default on a Merchant Cash Advance (MCA) begins with understanding the repayment structure and staying in control of your business’s cash flow. Since MCA payments are often deducted daily or weekly from your revenue, it’s essential to maintain consistent sales and ensure your business bank account always has sufficient funds to cover these withdrawals.

One of the most effective ways to prevent default is to closely monitor your income and expenses, allowing you to anticipate shortfalls before they happen. Additionally, communicate with your MCA provider if you foresee payment difficulties—some may offer temporary relief or restructuring options. Avoid taking on multiple MCAs at once, as stacking advances can rapidly lead to unmanageable debt.

Lastly, make sure you fully understand the terms of your agreement, including default clauses, so you can operate your business within those boundaries and reduce the risk of triggering a default due to technical violations.

Potential Consequences of Defaulting on a Merchant Cash Advance

Defaulting on a Merchant Cash Advance (MCA) can trigger a cascade of severe consequences that affect both your business operations and your personal finances. Since MCAs are high-risk agreements for lenders, they often come with strict and immediate penalties for default. The most common consequence is that the remaining balance of the advance becomes due in full immediately, even if you’ve only missed a few payments. This can create instant financial stress and may paralyze your business’s cash flow.

Many MCA contracts include confession of judgment (COJ) clauses, which allow the lender to obtain a court judgment without notifying you in advance. This enables them to freeze your bank accounts, seize funds, or garnish your income through legal channels. If your contract includes a personal guarantee, the consequences could extend beyond your business—you could be held personally liable, putting your personal savings, property, and credit score at risk.

Additionally, defaulting on an MCA can result in a UCC lien being filed against your business, which negatively impacts your ability to secure future financing. Your company’s creditworthiness will suffer, and your relationships with banks, suppliers, and potential investors may be damaged. Moreover, many MCA lenders work with aggressive collection agencies that may use persistent and intense collection efforts, often adding to your stress and disrupting your business operations.

In the long term, the reputational and financial harm from an MCA default can take years to recover from. That’s why it’s vital to seek professional help and communicate early with your provider if you’re struggling to meet payment obligations.

Conclusion

Defaulting on a Merchant Cash Advance (MCA) can have severe financial, legal, and operational consequences for your business. The structure of an MCA, with its daily or weekly repayment schedule, can be overwhelming if not managed carefully. It’s crucial to understand the terms of your agreement, recognize the early signs of financial strain, and take immediate action to avoid default. Open communication with your MCA provider, seeking professional help, and managing your business’s cash flow effectively are key strategies to avoid the harsh penalties of default. If you find yourself already in default, it’s essential to act quickly—whether through negotiation, restructuring, or exploring alternative financing options—to minimize the damage to your business and personal finances. Ultimately, proactive management and early intervention are the best ways to protect your business from the long-term repercussions of defaulting on an MCA.

FAQS

Q: What happens if I default on an MCA but can’t pay back the full balance immediately?

If you default on an MCA, the lender may immediately demand the full repayment of the remaining balance. The terms of most MCAs allow for aggressive collection methods such as seizing business assets, freezing bank accounts, or even garnishing personal assets if you signed a personal guarantee. However, some lenders may agree to a repayment plan or settlement if approached early.

Q: Are there any alternatives to defaulting on an MCA?

Yes, there are several alternatives to defaulting on an MCA. You can attempt to renegotiate your terms directly with the provider or seek the help of a professional debt relief firm that specializes in MCAs. Additionally, businesses may consider alternative financing options such as small business loans (e.g., SBA loans), invoice factoring, or lines of credit with better terms.

Q: Can MCA lenders pursue legal action immediately after default?

Yes, many MCA contracts contain a Confession of Judgment (COJ) clause that allows the lender to file a lawsuit and obtain a court judgment against your business without prior notice. This means they could seize funds directly from your bank accounts or take legal action to recover the full balance, often without going through the standard legal proceedings.