UCC Data vs Business Credit Reports: Key Differences and Why They Matter

In today’s competitive business environment, understanding your financial footprint is critical. Two key tools for evaluating a business’s financial reliability are UCC data and business credit reports. While they may sound similar and even overlap in some areas, they serve distinct purposes and offer unique insights into a company’s creditworthiness and financial obligations.

UCC data—short for Uniform Commercial Code filings—provides detailed records of secured transactions, whereas business credit reports offer a broader overview of a company’s credit history, payment behaviors, and overall financial reputation. Both are essential for lenders, suppliers, and even competitors looking to assess the financial risk associated with doing business with a company.

In this article, we’ll break down the key differences between UCC data and business credit reports, why each is important, and how businesses can use them to make informed decisions.

What is UCC Data?

The Uniform Commercial Code (UCC) is a standardized set of laws governing commercial transactions in the United States. UCC filings, particularly UCC-1 financing statements, are public notices that a creditor has a secured interest in a debtor’s personal or business assets.

When a lender finances a loan with collateral—such as equipment, inventory, or receivables—they typically file a UCC-1 form to publicly declare their interest in the collateral. This helps protect their legal rights if the borrower defaults.

Key Characteristics of UCC Data:

- Publicly available via state filing offices.

- Filed by lenders or creditors.

- Lists the borrower, lender, collateral, and filing details.

- Typically valid for five years, with the option to renew.

- Used to establish priority in claims over assets.

UCC data is crucial in industries where equipment leasing or inventory financing is common. For example, if Company A applies for a loan and offers machinery as collateral, the bank files a UCC-1 to secure that interest. If Company A defaults, the bank has legal rights to seize the machinery.

What is a Business Credit Report?

A business credit report is a comprehensive document compiled by credit bureaus like Dun & Bradstreet (D&B), Experian, and Equifax. These reports summarize a business’s creditworthiness, including payment history, credit limits, outstanding debts, legal filings, and other financial indicators.

Credit bureaus gather data from vendors, lenders, public records, and financial institutions to build a credit profile. The goal is to assess how likely a business is to repay its obligations based on past behavior.

Components of a Business Credit Report:

- Credit score or rating (e.g., D&B PAYDEX score).

- Trade payment history.

- Credit utilization.

- Legal filings (bankruptcies, judgments, liens).

- Public UCC filings (often included).

- Company background (ownership, operations, etc.).

Unlike UCC data, which is purely about secured loans, business credit reports offer a holistic view of financial health and can influence a company’s access to trade credit, business loans, insurance, and partnerships.

Why Is a Business Credit Report Important?

A business credit report is a critical tool for evaluating a company’s financial reputation and ability to meet its obligations. Just as personal credit reports help lenders assess individual borrowers, business credit reports provide detailed insights into how a company manages debt, pays vendors, and handles credit lines. These reports—issued by bureaus such as Dun & Bradstreet, Experian Business, and Equifax Business—play a vital role in financing decisions, vendor relationships, insurance underwriting, and partnership evaluations.

One of the main reasons business credit reports are important is because they influence access to capital. Lenders use them to determine whether a business qualifies for loans, credit cards, lines of credit, or leasing arrangements. A strong report with timely payments and low credit utilization increases the chances of approval and favorable interest rates, while a poor report may lead to rejections or higher borrowing costs.

In addition, suppliers and vendors often review business credit reports before extending trade credit terms. A positive credit profile can lead to longer payment cycles or larger credit limits, which helps a business improve cash flow and scale operations more effectively. On the flip side, a negative report may force the business to pay upfront or operate on strict terms, limiting financial flexibility.

Another reason business credit reports are valuable is their role in business credibility and trustworthiness. When forming partnerships or bidding on contracts, potential collaborators often review these reports to ensure your company is financially stable. A good credit report enhances your brand’s reputation and can open doors to new opportunities.

Finally, business credit reports help business owners stay informed. By monitoring these reports regularly, companies can detect errors, unauthorized activity, or outdated UCC filings that might otherwise harm their borrowing capacity or public image.

How a UCC Filing May Affect Business Financing

A UCC filing can significantly influence a business’s ability to secure future financing. When a lender files a UCC-1 financing statement, it publicly declares a secured interest in specific business assets, such as equipment, inventory, or accounts receivable. While this filing itself does not damage a business’s credit score, it acts as a signal to other potential lenders that certain assets are already pledged as collateral.

If a new lender sees active UCC filings, they may perceive the business as highly leveraged or financially overcommitted, leading them to deny the application, request additional collateral, or offer loans with higher interest rates. Moreover, multiple or outdated UCC filings that were never terminated—even after a loan is paid off—can clutter a business’s credit profile and delay financing approvals.

Therefore, although a UCC filing is a standard part of secured lending, businesses must manage them carefully to maintain flexibility and attractiveness to future lenders.

How UCC Filings Affect Your Business Credit?

UCC filings do not directly impact your business credit scores, but they can influence how lenders and credit bureaus assess your creditworthiness. When a UCC-1 is filed, it becomes part of your public business record, alerting credit reporting agencies that certain business assets are tied to a loan.

While this doesn’t decrease your credit rating, it can raise red flags for potential creditors or partners who review your business credit report. Too many active UCC filings may give the impression that your business is overextended or heavily dependent on financing, which could negatively affect lending decisions.

In addition, if past lenders fail to terminate old UCC filings after debt repayment, these outdated records can create unnecessary complications, especially during due diligence or loan underwriting. To maintain a clean and favorable business credit profile, it’s crucial to monitor your UCC filings and ensure outdated ones are properly terminated.

How to Check for UCC Errors Using Your Business Credit Scores?

Monitoring your business credit reports is essential for identifying and correcting any UCC filing errors that could affect your financing opportunities. Major commercial credit bureaus like Dun & Bradstreet, Experian Business, and Equifax Business include UCC filing data in their reports. By regularly reviewing your business credit reports, you can spot inaccurate, duplicate, or outdated UCC filings that might raise concerns with future lenders.

Start by requesting your credit report from each bureau. Under the UCC section, look for filings that seem unfamiliar, have already been satisfied, or were filed by unknown entities. Pay close attention to the filing dates, lender names, and collateral descriptions. If you find errors—such as a UCC filing that should have been terminated after a loan was paid off—you should reach out to the creditor and request a termination statement. You can also contact the Secretary of State’s office where the filing was made to check for proper updates.

Correcting these issues ensures your credit profile accurately reflects your business’s current financial standing. In turn, this improves your credibility and increases your chances of securing favorable financing. Routine checks of your credit reports and UCC records are a smart practice for keeping your business’s financial reputation strong.

What UCC Filings Show That Credit Reports Don’t?

UCC filings provide detailed insights into your business’s financial obligations that are often not fully disclosed in standard credit reports. While credit reports typically include information like payment history, credit limits, and outstanding balances, UCC filings reveal specific collateral agreements tied to a loan or credit line. This means they show what assets (such as equipment, inventory, receivables, or intellectual property) a business has pledged to a creditor — a level of transparency credit reports generally lack.

Furthermore, UCC filings indicate the priority of claims on business assets, showing which lender has a senior secured interest. This hierarchy is crucial for potential lenders assessing whether your business has any unencumbered assets available for use as collateral. Unlike credit reports, UCC filings also show filing dates, expiration dates, and whether a filing has been renewed, amended, or terminated, offering a chronological view of secured borrowing activity.

Additionally, UCC filings can reveal hidden or informal financing arrangements, such as factoring or merchant cash advances, that might not always appear on a business credit report. These insights help lenders and investors better assess financial risk by understanding both the amount and nature of a business’s debt obligations. In short, while credit reports offer a summary of financial health, UCC filings expose the deeper structure of a business’s financial commitments.

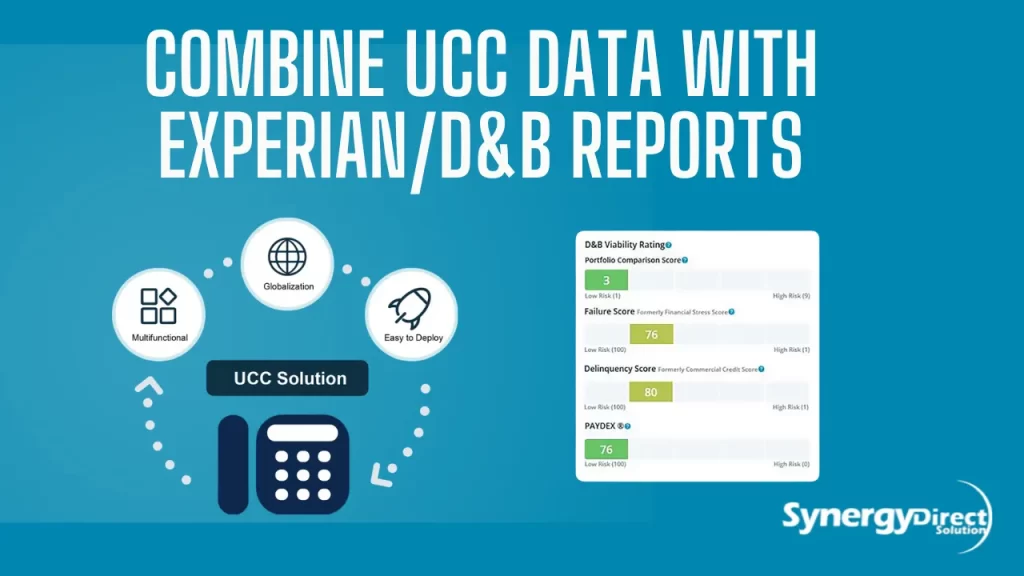

How to Combine UCC Data with Experian/D&B Reports?

Combining UCC leads data with Experian and Dun & Bradstreet (D&B) business credit reports provides a more comprehensive view of your company’s financial health and borrowing risks. This integrated approach allows you to evaluate not only your credit performance but also your secured debt obligations and collateral exposure, giving lenders and stakeholders a clearer picture of your financial position.

To start, request your business credit reports from both Experian Business and D&B. These reports typically include UCC filing summaries, but they may not always show full details. To access complete UCC data, visit the Secretary of State’s website where your business is registered and download the full UCC-1 filings associated with your business. These filings include essential data like lender names, filing dates, collateral descriptions, and termination statuses.

Once you have both reports and full UCC records, create a cross-reference list. Look at your credit report for indicators such as open credit accounts, past due payments, or high credit utilization, then align these with your UCC filings. For example, if your Experian report shows an active credit line and your UCC filing shows that line is secured by your receivables, you now understand both the payment behavior and asset risk related to that debt.

Also, use this combined data to spot inconsistencies—for instance, if a loan is marked “closed” on your D&B report but still has an active UCC filing, you’ll know it’s time to contact the lender for a termination. By reviewing both data sets regularly, you’ll maintain a clean and transparent financial profile, reduce your risk of financing denials, and position your business for better lending terms and investor confidence.

u

u

Why UCC Data Is a Better Lead Source in Some Cases?

UCC data can be a superior lead source compared to traditional business credit reports in certain marketing and lending scenarios because it provides real-time, actionable insights into businesses actively seeking or using secured financing. While credit reports give a broad overview of a company’s financial history, UCC filings offer specific, event-driven information—indicating a business has recently received a loan, equipment lease, or financing for expansion. This makes UCC filings a powerful trigger for sales and lending opportunities, especially for financial institutions, leasing companies, and B2B service providers.

One of the key advantages of UCC data is timeliness. Filings are recorded almost immediately after a transaction takes place, often before the activity appears on a credit report. This gives marketers and lenders a first-mover advantage in reaching out to businesses that have just acquired financing or assets, allowing them to offer complementary services, refinancing options, or upgrades when the business is most likely to buy.

Additionally, UCC filings reveal industry-specific patterns that credit reports don’t. For example, a surge in equipment-related UCC filings in the construction sector might signal growth, making it a fertile ground for vendors, suppliers, or commercial lenders. UCC filings also include lender information, which allows for competitor analysis and targeting businesses working with specific banks or leasing firms.

In some cases, businesses that are too new to have an extensive credit profile may still appear in UCC records because of recent financing. This opens the door to emerging or fast-growing companies that are otherwise invisible in traditional lead databases.

Conclusion

Understanding the distinction between UCC data and business credit reports is crucial for making sound financial decisions. While UCC filings highlight secured loans and asset-backed obligations, business credit reports deliver a wider view of a company’s financial reputation, including creditworthiness, vendor relationships, and legal standings. Together, they provide lenders, vendors, and business owners with the insights needed to assess financial risk, secure financing, and build trustworthy business partnerships.

FAQS

- Do UCC filings affect my business credit score?

No, UCC filings do not directly impact your credit score. However, they appear on business credit reports and may influence how lenders perceive your financial obligations. - How long do UCC filings stay active?

A UCC-1 filing is typically active for five years but can be renewed before expiration. Outdated filings should be terminated once the debt is satisfied. - Can I remove an inaccurate UCC filing from my record?

Yes. If you find an inaccurate or outdated UCC filing, contact the original creditor to file a termination. You can also reach out to the Secretary of State where it was filed for assistance. - Where can I find my UCC filings?

UCC filings are publicly available through the Secretary of State’s office in the state where your business is registered. Many states offer searchable online databases. - Why should I combine UCC data with credit reports?

Combining UCC data with business credit reports gives a fuller picture of your financial health—highlighting both your credit performance and your secured obligations. This can improve financing opportunities and risk management.