MCAs for Startups: Is It Possible to Secure Funding?

Startups often face the challenge of securing funding, especially in their early stages. Traditional loans, equity financing, and venture capital are common funding options, but they are not always feasible for new businesses. One alternative that has gained popularity in recent years is the Merchant Cash Advance (MCA).

This form of funding is distinct from traditional loans, offering startups a flexible and relatively quick way to access capital. But is it possible for startups to secure funding through an MCA? The answer is yes, but several factors must be considered. This article explores how MCAs work for startups, which startups are most likely to secure one, and why a startup might choose an MCA as a funding source.

What is a Merchant Cash Advance (MCA)?

Before diving into whether startups can secure an MCA, it’s important to understand what an MCA is. An MCA is not a loan in the traditional sense; instead, it’s a financing arrangement where a business receives a lump sum of money in exchange for a percentage of its future credit card sales or daily bank deposits. The amount of money a business can borrow is based on the volume of its sales, making it different from a standard loan where credit history and assets are the primary considerations.

MCAs are considered a form of “alternative financing” because they are not provided by traditional banks. They are often provided by private lenders or specialized financial institutions. These lenders take a higher risk than traditional banks, but in return, they charge higher fees and interest rates.

Is It Possible to Secure an MCA for a Startup?

Yes, startups can secure an MCA, but the process can be different from securing other types of financing. Unlike traditional loans, which require a strong credit history, a well-established business track record, or significant assets, MCAs are based on a business’s future sales. This makes them accessible for startups, even those without a long history or a strong credit score.

However, the chances of securing an MCA will depend on several factors, including the type of business, its sales volume, and its ability to generate consistent revenue. Businesses that can demonstrate steady daily or monthly sales are more likely to qualify for an MCA. For startups, this means having a predictable sales model, such as those in industries like retail, e-commerce, and food service.

Which Startups Are Most Likely to Secure an MCA?

While any startup can technically apply for an MCA, those most likely to qualify typically meet certain criteria. Here are some of the key factors that make a startup a strong candidate for an MCA:

Consistent Sales

Startups with consistent daily or monthly sales are better candidates for securing an MCA. Lenders look at the business’s ability to generate steady income as a predictor of future sales. Startups with unpredictable or seasonal revenue may still qualify, but the terms of the MCA may be less favorable.

High Credit Card Sales or Bank Deposits

MCA lenders typically prefer businesses that receive a large portion of their sales through credit cards or bank deposits. This is because they can easily track these transactions and determine the business’s ability to repay the advance. Businesses with high credit card or bank transaction volumes are more likely to secure an MCA because the repayment is directly tied to these transactions.

Established Industry Presence

Startups in industries with proven demand, such as retail, restaurants, and online businesses, are more likely to qualify for an MCA. These industries tend to have predictable cash flow, which gives lenders confidence in the business’s ability to repay the loan. Startups in emerging or niche markets may find it more challenging to secure an MCA due to the higher perceived risk.

Positive Cash Flow

Although MCA lenders are not as focused on credit scores as traditional lenders, they still look at a business’s cash flow to ensure it can repay the advance. Startups with positive cash flow, even if they are in their early stages, are more likely to secure an MCA. Lenders need assurance that the business can generate enough revenue to make daily or weekly payments.

Which Startups Are Most Likely to Secure an MCA?

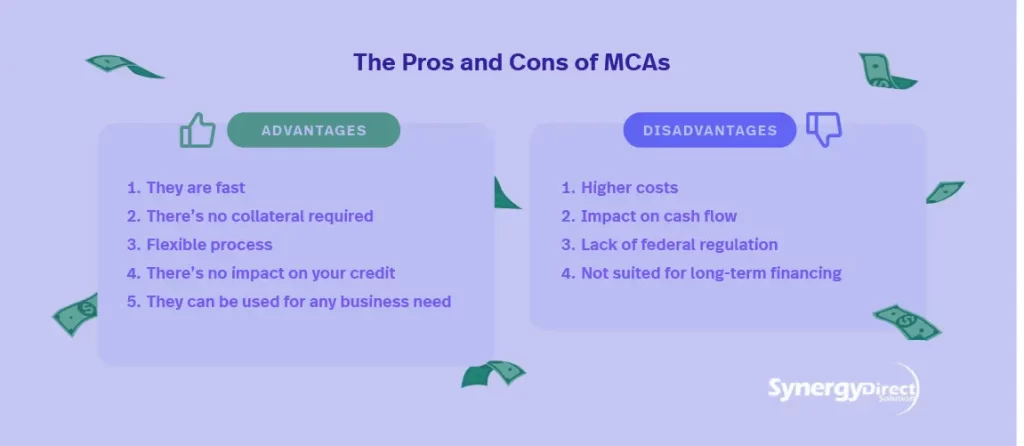

Startups may consider an MCA for several reasons, each catering to different needs and business conditions. Here are some of the main advantages of choosing an MCA as a funding source:

Fast and Easy Access to Capital

One of the primary reasons startups opt for an MCA is the speed of funding. Unlike traditional loans, which can take weeks or even months to process, MCAs are usually approved within a few days. This quick turnaround time is crucial for startups that need immediate capital to cover operational costs, expand their business, or seize a market opportunity.

No Collateral Required

Many startups lack the physical assets necessary to secure traditional loans. With an MCA, there is no need for collateral. The funding is based on future sales, which makes it an attractive option for startups that don’t have assets like real estate or equipment to pledge.

Flexible Repayment Structure

An MCA has a unique repayment structure compared to traditional loans. Instead of fixed monthly payments, repayments are tied to the startup’s daily sales. This means that if the business experiences a slow period, the repayment amount will be lower, providing flexibility. On the other hand, if the business performs well, the repayment amount will increase accordingly.

Fewer Eligibility Requirements

Startups with limited credit history or lower credit scores often struggle to secure traditional loans. MCA lenders are less concerned with credit scores, focusing instead on the business’s ability to generate revenue. This can make MCAs an ideal solution for startups that may not qualify for other types of financing.

No Equity Dilution

Unlike venture capital or angel investments, taking out an MCA doesn’t require giving up equity in the business. This is important for startup founders who want to retain full control over their company and avoid diluting ownership.

Ideal for Seasonal or Fluctuating Sales

For businesses with fluctuating or seasonal sales, an MCA offers a flexible solution. Since repayments are tied to daily revenue, businesses in industries with seasonal demand can manage slow periods more easily without the burden of fixed monthly loan payments.

Risks and Considerations of MCAs for Startups

While MCAs can be beneficial for startups, they are not without risks. Here are some of the potential downsides of using an MCA for funding:

High Costs

One of the main disadvantages of an MCA is the high cost of borrowing. MCA lenders typically charge high factor rates, which can make repayment more expensive than traditional loans. In addition, the fees associated with MCAs can be significant, leading to a higher overall repayment amount.

Cash Flow Pressure

Since MCA repayments are tied to daily sales, a startup with fluctuating revenue may face cash flow pressure during slower periods. If a business experiences a downturn, it could struggle to meet repayment obligations, leading to financial strain. This is especially problematic for startups that have unpredictable sales patterns.

Short Repayment Terms

Unlike traditional loans with longer repayment terms, MCAs typically require repayment within a year or less. The short repayment period can put pressure on a startup to generate quick revenue to meet its obligations. If the business doesn’t grow fast enough, it may find itself in a difficult position.

Potential for Debt Cycle

If a startup is unable to meet its repayment terms, it may take out another MCA to cover the existing debt, leading to a cycle of borrowing. This can quickly spiral out of control if the business doesn’t generate enough revenue to repay the advances, causing the startup to fall into a debt trap.

Risk of Over-borrowing

Startups may be tempted to take out an MCA based on their projected sales, but if those projections fall short, they could find themselves over-leveraged. It’s important for startups to carefully assess their ability to repay before taking on this type of financing.

Conclusion: Is an MCA the Right Choice for Your Startup?

Merchant Cash Advance can be an attractive option for startups in need of quick capital, especially for businesses with consistent sales and positive cash flow. They offer flexibility, fast access to funds, and no collateral requirements. However, the high cost and short repayment periods make MCAs a potentially risky financing option.

Startups should carefully consider their sales volume, ability to repay, and long-term financial goals before opting for an MCA. For some startups, an MCA might provide the necessary funds to grow and expand, but it’s crucial to manage the repayment terms carefully to avoid financial strain.

Ultimately, whether an MCA is the right choice depends on the specific needs and financial situation of the startup. By weighing the pros and cons, startups can make an informed decision that best supports their growth and success.