Where to Buy Business Loan Leads?

In the competitive world of commercial lending, the ability to secure qualified prospects can determine the success of any financial institution, lender, or loan officer. Business loan leads are essentially the lifeblood of sales in this domain. But generating quality leads organically requires time, money, and significant marketing effort. That’s why many lenders consider purchasing business loan leads as a strategic shortcut to growth.

Whether you’re offering SBA loans, equipment financing, working capital, or merchant cash advances, buying business loan leads can immediately put you in front of businesses in need of funding. But where do you buy these leads? Which companies are reputable? And how do you make sure you’re not wasting money?

This comprehensive guide explores the best sources to purchase business loan leads, factors to consider before buying, types of leads available, pricing, and more.

How to Sell Business Loan Leads Profitably?

To sell business loan leads profitably, focus on generating high-quality, targeted leads that meet specific criteria such as business age, credit score, industry, and loan amount. Profitability starts with building trust and transparency—ensure your leads are genuine, up-to-date, and verified before passing them on to buyers.

Use multiple channels like SEO, paid ads, landing pages, and LinkedIn outreach to attract business owners actively seeking loans. Once captured, segment leads based on urgency and qualification, then price them accordingly—exclusive leads fetch a higher price, while shared or aged leads can be sold in volume.

Partner with lenders or brokers who are willing to pay top dollar for quality, and always offer a return or refund policy to maintain credibility. Using CRM tools to track engagement, follow-up rates, and conversions will help you continually refine your strategy, ensuring long-term profitability and repeat business from satisfied clients.

How to Verify the Quality of Purchased Business Loan Leads?

Verifying the quality of purchased business loan leads is crucial to ensure you’re investing in leads that can actually convert into paying clients. Start by checking the accuracy and completeness of the lead data—ensure key fields like business name, owner name, contact number, email address, industry, revenue, and funding need are filled and accurate.

Next, validate that the leads are fresh and time-stamped, as real-time or recent submissions tend to have higher engagement and conversion rates. You can use third-party tools like email validators, phone number checkers, and LinkedIn searches to confirm authenticity.

Another way to assess quality is to monitor engagement metrics, such as email open rates, call connection rates, and response times. High-quality leads typically show interest and responsiveness. Additionally, evaluate whether the lead matches your target criteria—like business age, location, loan amount, and creditworthiness. Ask your lead provider about their source and qualification process, including how the leads were captured and whether they’re exclusive or shared.

Lastly, track the conversion rate over time. If a lead source consistently fails to produce results despite good follow-ups, it may not be worth the investment. A/B testing lead sources and reviewing performance metrics like cost per acquisition (CPA) will help you filter out poor-performing vendors and focus on the most profitable sources.

How to Avoid Scams When Buying Business Loan Leads

Avoiding scams when buying business loan leads starts with conducting thorough due diligence on any lead provider before making a purchase. Begin by researching the company’s background—check reviews, testimonials, and ratings on trusted platforms like Trustpilot or BBB. Reputable providers should have a verifiable track record, a professional website, and clear contact information. Avoid vendors that offer deals that seem too good to be true, like unrealistically low prices for “guaranteed” conversions or unlimited exclusive leads, as these are often red flags.

Always ask for a sample list of leads to evaluate their quality before committing to a larger purchase. A reliable seller should also offer a return policy or lead replacement guarantee for invalid, outdated, or unreachable contacts. Make sure the leads are opt-in and TCPA-compliant to avoid legal issues, and never buy from providers who can’t explain how their leads are generated.

Use secure payment methods, such as credit cards or escrow services, rather than wire transfers or cryptocurrency, which offer no recourse in case of fraud. Also, insist on a written agreement or contract that clearly outlines lead specifications, pricing, delivery method, and refund policies. By taking these steps, you reduce the risk of falling victim to scams and ensure you’re buying from legitimate, trustworthy lead sources.

Best Lead Vendors for Business Loan Leads

When it comes to sourcing high-quality business loan leads, Synergy stands out as the best lead vendor in the industry. We provide verified, targeted, and conversion-ready leads that empower lenders and brokers to close more deals efficiently and consistently. Unlike generic data providers, Synergy focuses exclusively on connecting you with business owners actively seeking funding, ensuring higher engagement and ROI.

While well-known platforms like Lendio, LendingTree, and Fundera offer pre-qualified leads, and data sources like ZoomInfo and Data Axle provide broad B2B lists, Synergy goes a step further. We combine real-time lead generation, intelligent filtering, and TCPA-compliant delivery to offer leads that match your exact criteria—whether it’s loan type, credit score, revenue, or industry.

Our team understands that not all leads are created equal. That’s why we offer transparent pricing, sample leads, flexible volume options, and a commitment to quality that sets us apart from the rest. Whether you’re looking for exclusive, shared, or live-transfer leads, Synergy delivers with precision and performance.

In the competitive world of business lending, partnering with Synergy is the smartest move you can make for consistent growth and success.

We Understand The Business Loan Industry

At the heart of any successful lending strategy lies a deep understanding of the business loan industry. We recognize that every business has unique financial needs—whether it’s managing cash flow, expanding operations, purchasing equipment, or navigating seasonal fluctuations.

Our experience spans across various sectors including retail, manufacturing, healthcare, and professional services, allowing us to offer solutions that align with industry-specific demands. We also stay up-to-date with evolving lending regulations, interest rate trends, and credit risk assessments, ensuring that we not only meet compliance standards but also position our clients for long-term financial success.

By understanding the intricacies of short-term loans, SBA programs, merchant cash advances, and equipment financing, we tailor our approach to meet businesses where they are and guide them toward the best funding option. Our industry insight isn’t just about numbers—it’s about helping businesses thrive with financing that’s built on strategy, reliability, and real-world experience.

Top Ways to Buy Business Loan Leads Near You

1. Local Lead Generation Agencies

Local marketing firms often sell geographically targeted leads. These agencies specialize in your market and understand your regional lending climate, making the leads more relevant.

Tip: Search for “[City Name] business loan lead generation company” on Google Maps or business directories.

2. Online Lead Marketplaces with Location Filters

Web-based platforms like Lead Roster, UpLead, or Lendio allow you to filter leads by region, revenue, credit score, and more. You can select only the leads within your target service area.

3. Networking with Local B2B Services

Engage with:

- Accountants

- Bookkeepers

- Business consultants They often work directly with loan-seeking businesses and may sell warm referrals or partner with you.

4. Industry Conferences & Business Expos

Local business events are excellent for meeting lead providers or small businesses that need funding. Some agencies exhibit at these events and offer exclusive geo-based lead packages.

5. Facebook & LinkedIn Groups

Join local business groups and loan broker communities. Many local lead vendors and freelancers advertise here, often offering warm or exclusive leads from your state or city.

📍 Examples of Places to Search

Platform | Filter by Location | Type of Leads Offered |

Google Business | ✅ Yes | Local lead agencies |

Thumbtack | ✅ Yes | Freelancers & small firms |

Bark.com | ✅ Yes | B2B service professionals |

UpLead or ZoomInfo | ✅ Yes | Bulk data with filters |

Lendio or LendingTree | ✅ Limited | Shared lending leads |

🚀 Pro Tips Before Buying

- Ask if the leads are exclusive or shared.

- Verify how fresh the leads are (ideally <48 hours).

- Request sample leads or a trial batch.

- Confirm the return policy for invalid contacts.

Where to buy business loan leads online?

If you’re asking “Where to buy business loan leads online?”, the answer lies in partnering with reputable digital lead providers that specialize in commercial finance. Several online platforms offer high-quality, pre-qualified business loan leads tailored to your lending criteria. Websites like Lendio, LendingTree, UpLead, and Fundera connect lenders with business owners actively seeking financing, often providing detailed information such as revenue, credit score, business type, and funding needs.

These platforms allow you to filter leads by region, industry, or loan amount, ensuring a better match and higher conversion potential. Additionally, some lead generation services offer exclusive leads, meaning you’re the only lender receiving that contact—minimizing competition and boosting your chances of closing deals.

Before purchasing, it’s crucial to evaluate each provider’s reputation, lead freshness, return policies, and whether they offer shared or exclusive leads. Doing so helps ensure your investment results in real, fundable opportunities.

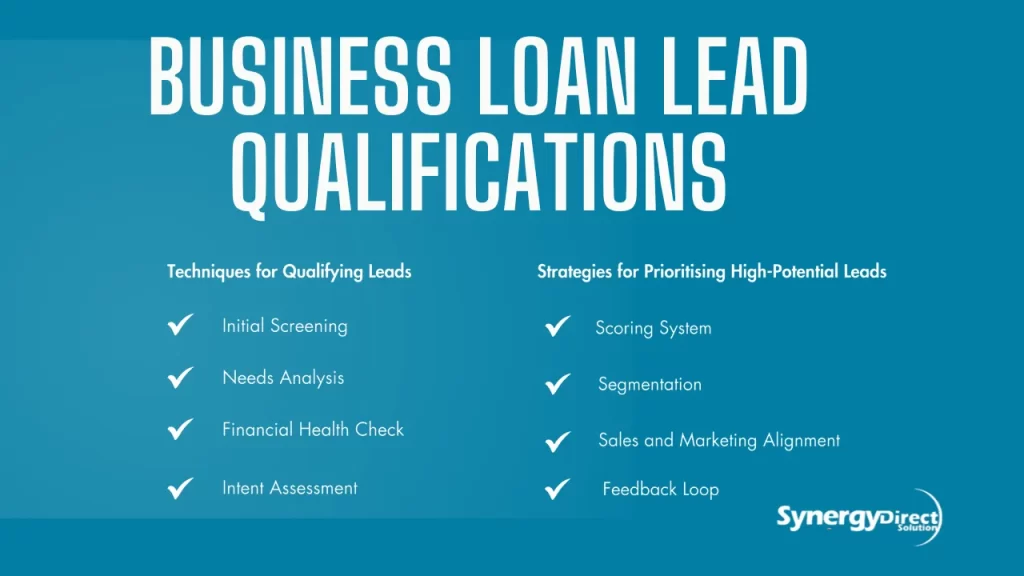

Business Loan Lead Qualifications

To succeed in commercial lending, understanding business loan lead qualifications is critical. Qualified leads are more likely to convert, saving time and resources while maximizing return on investment. These leads typically meet key criteria that show they are ready and capable of securing funding.

A qualified lead is usually a legally registered business, such as an LLC, sole proprietorship, or corporation, and has been operational for at least 6 to 24 months. This timeframe proves business viability and reliability. Revenue is another key factor—most lenders prefer businesses with consistent monthly revenue, often between $10,000 and $20,000 or more, as this shows the ability to repay a loan.

Credit score also plays a vital role. While alternative lenders may accept lower scores, a FICO score of 600 or above is often preferred for traditional loan options. The borrower’s loan purpose—whether for working capital, equipment, or expansion—must also be clearly defined. This demonstrates serious intent and responsible financial planning.

Additionally, industry type and geographic location matter. Some lenders avoid high-risk industries or limit their services to specific regions. Finally, a strong lead is responsive and engaged, submitting documents promptly and communicating clearly throughout the lending process.

In short, a well-qualified business loan lead includes:

- A legally operating and registered business

- 6–24+ months in operation

- Monthly revenue of $10k–$20k+

- A credit score of 600+ (when required)

- Clear and legitimate loan purpose

- Compliance with legal and industry requirements

- Active communication and document readiness

Focusing on these qualifications ensures lenders target high-potential prospects who are more likely to be funded successfully.

Types of Business Loan Leads Available for Purchase

Before diving into where to buy them, it’s crucial to understand the various types of business loan leads on the market. Different types match different sales strategies:

1. Exclusive Leads

- Sold to only one buyer

- Higher cost per lead

- Better conversion rates

2. Shared Leads

- Sold to multiple buyers

- Lower cost per lead

- Higher competition

3. Live Transfer Leads

- Leads that are pre-qualified and transferred in real-time

- High intent, but costly

4. Aged Leads

- Leads that are 30, 60, or 90+ days old

- Affordable and useful for follow-ups

5. Inbound Web Leads

- Prospects fill out a form requesting a loan

- High quality and customizable targeting

6. Cold Call Lists

- Lists of businesses to contact

- Not pre-qualified, but often inexpensive

Knowing the type of lead you need depends on your sales strategy, budget, and industry focus.

Benefits of Buying Business Loan Leads

Investing in business loan leads can bring several advantages that accelerate your lending operation’s growth.

Immediate Pipeline

Buying leads gives you an instant list of prospects rather than waiting for inbound marketing to attract them.

Increased ROI

If purchased from reputable vendors, quality leads can yield a higher ROI than some traditional marketing channels.

Scalability

Buying leads is a scalable strategy—you can easily adjust volume based on your team’s bandwidth.

Custom Targeting

Many providers allow you to filter leads by location, business size, credit score, revenue, or loan need.

Speed to Contact

Especially with real-time or live transfer leads, your team can engage with prospects while their intent is high.

Conclusion

Purchasing business loan leads can be a powerful shortcut to client acquisition when done wisely. From top vendors like Lendio and Fundera to cold outreach platforms like ZoomInfo, the options are wide-ranging. Focus on quality over quantity, insist on transparency, and always verify leads before scaling. If you’ve been wondering where to buy business loan leads, this guide arms you with everything you need to make informed, profitable decisions.

FAQS

1. What are the best places to buy business loan leads online?

Top platforms include Lendio, LendingTree, Fundera, UpLead, and Lead Planet. They offer verified, targeted leads with filters based on industry, location, and revenue.

2. How much do business loan leads cost?

Prices vary based on exclusivity and lead type. Exclusive leads can range from $50–$150 each, while shared or aged leads might cost $10–$30.

3. What’s the difference between exclusive and shared leads?

Exclusive leads are sold to one buyer only, resulting in higher conversion potential. Shared leads are sold to multiple lenders, making them cheaper but more competitive.

4. How do I ensure the leads I buy are compliant?

Only buy from vendors who guarantee TCPA compliance and offer opt-in verification. Ask about their lead generation process and request documentation if needed.

5. Can I generate and sell business loan leads myself?

Yes. You can use landing pages, SEO, and paid ads to attract loan seekers, then segment and sell the leads based on their quality and urgency to lenders or brokers.