Credit score is an important topic for many people in my inner circle. For example, I talk to a lot of people that want to increase their credit scores but they are not sure what steps to take. Some people find it challenging to manage the key factors that influence their credit. Other people have been practicing these techniques for years. However, for others it’s not that easy. Our school system doesn’t teach us anything of value with regard to credit scores, banking, balancing your checkbook, etc.

Consequently, I thought I’d help some people out with a quick article about one of these factors that can impact your score.

I’d like to tell you about a formula to help you estimate how various credit problems can cost you in terms of your overall credit score.

Here are the three big questions that I typically get:

- How can I calculate my credit score?

- Does my score drop by a certain amount if I do something bad?

- How can I improve my score?

I’m here to explain all that and more!

Shall we begin?

So, how can you calculate your credit score?

Your credit score is one of the most important measures of your creditworthiness. For your FICO® Credit Score, it’s a three digit number usually ranging between 300 to 850 and is based on metrics developed by Fair Isaac Corporation. The higher your score is, the less risky you are to lenders. By understanding what impacts your score, you can take steps to improve it.

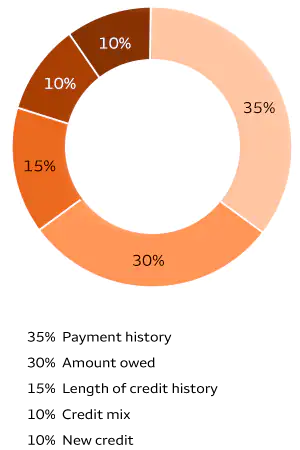

Specifically, there are 5 important factors that affect your score.

- Payment History — 35% of your score depends on making your payments on time. How often you miss payments can effect your score. Additionally, paying your bills very late can negatively effect your credit.

- Amount Owed — 30% of your score depends on how much you owe on loans and credit cards. This is the total amount that you owe on all of your accounts. However, another factor here is how much credit you still have left. Credit utilization is the percentage of credit that you are currently using. 30% Credit Utilization is good. However, the lower the better when it comes to credit utilization.

- Length of Credit History — 15% of your score depends on how old your oldest credit card card is.

- Credit Mix — 10% of your score depends on the mix of credit acc you have. For example, do you have only credit cards? Or do you have installment loans, home loans, and retail cards as well? Having a mix can help increase your score.

- New Credit — 10% of your score depends on your recent credit card activity and specially applying for new credit cards. Creditors might look at your new credit cards as new financial trouble.

How Credit Problems Affect Your Score:

- Make sure you’re making all your payments on time. A late payment can lower your score by 100 points on your credit profile! Ultimately, this can ruin your profile.

- Applying for several credit cards will cause your score to decline by 15 points each time you have a hard inquiry on your credit profile.

- Additionally, too many charge-offs will cost your credit score 110 points!

- Collection accounts on your credit report can stay on your credit report for seven years and it will cost you 110 credit score points. This is why I recommend paying all debt on time, no matter how small.

- If you have a foreclosure on your credit, you will lose up to 160 points on your credit score!

At Synergy we help business owners get approved for business loans even if they’re high risk. We have a very simple onboarding process where we call you to find out the important details about your business and then we match you to a lender that should be able to give you the best possible options for your credit profile.

FAQS

What is my credit score meaning?

Your credit score is a numerical representation of your creditworthiness, which is based on your financial history. It helps lenders, banks, and other financial institutions assess how risky it might be to lend you money or extend credit. The score is influenced by various factors like your payment history, amount of debt, length of credit history, types of credit used, and any new credit inquiries. A higher credit score suggests that you’re a low-risk borrower, while a lower score indicates higher risk.

What is a good credit score?

A “good” credit score typically falls within the range of 670 to 739 on the FICO scale, which is the most commonly used credit score system. Here’s a breakdown of the FICO score ranges:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Excellent

Having a good credit score (670 and above) makes it easier to get approved for loans and credit cards and often means you’ll receive better interest rates.

How can I check my credit score for free?

You can check your credit score for free through a variety of services:

-

Credit Reporting Agencies: Major credit bureaus like Experian, Equifax, and TransUnion offer free access to your credit report once a year through AnnualCreditReport.com (though it may not include your credit score).

-

Online Financial Tools: Some online services like Credit Karma, Mint, and NerdWallet allow you to view your credit score for free, though they may show scores based on different models (e.g., VantageScore vs. FICO).

-

Banks & Credit Card Providers: Many banks and credit card companies offer free access to your credit score as part of their customer services. Check your online banking account or credit card app.

How do you get a credit score?

Your credit score is calculated based on your credit report, which is maintained by credit bureaus. Here’s how the scoring process works:

-

Credit Reporting Agencies: The major credit bureaus (Equifax, TransUnion, and Experian) gather data on your credit activities, such as how much you owe, your payment history, and the types of credit you use.

-

FICO and VantageScore: The two most common scoring models, FICO and VantageScore, use slightly different algorithms but rely on similar factors to generate your score.

-

Factors Impacting Your Score:

- Payment History (35%): Whether you pay your bills on time.

- Credit Utilization (30%): How much of your available credit you’re using.

- Length of Credit History (15%): The average age of your credit accounts.

- Types of Credit (10%): The variety of credit accounts you have, like credit cards, mortgages, and car loans.

- New Credit (10%): Recent credit inquiries or new accounts opened.

By maintaining a good track record with these factors, you can improve or maintain your credit score.

If you’re a lender and are interested in joining our network please feel free to check us out online at https://synergydirectsolution.com.

Are you looking for Business Loan Leads you can go to: https://synergydirectsolution.com/business-loan-leads/

Alternatively, if you’re looking for MCA Leads you can go here. https://synergydirectsolution.com/mca-leads/

Are you looking for Exclusive MCA Leads you can go to: https://synergydirectsolution.com/exclusive-mca-leads/

If you’re looking for Business Loan Live Transfers you can go to: https://synergydirectsolution.com/business-loan-live-transfers/

Are you looking for Aged MCA Leads you can go to: https://synergydirectsolution.com/aged-mca-leads/

If you’re looking for Merchant Cash Advance Appointments you can go to: https://synergydirectsolution.com/merchant-cash-advance-appointment-leads/